Achieve financial freedom with smart habits

Achieve financial freedom with smart habits

Nov 25, 2025

9 min read

The way we bank is changing. With the rise of neobanks digital-only banks people now have an alternative to traditional brick-and-mortar banks. But which one is the right fit for you? To decide, it’s important to understand how they differ, their strengths, and what kind of user each one best serves.

What Are Neobanks?

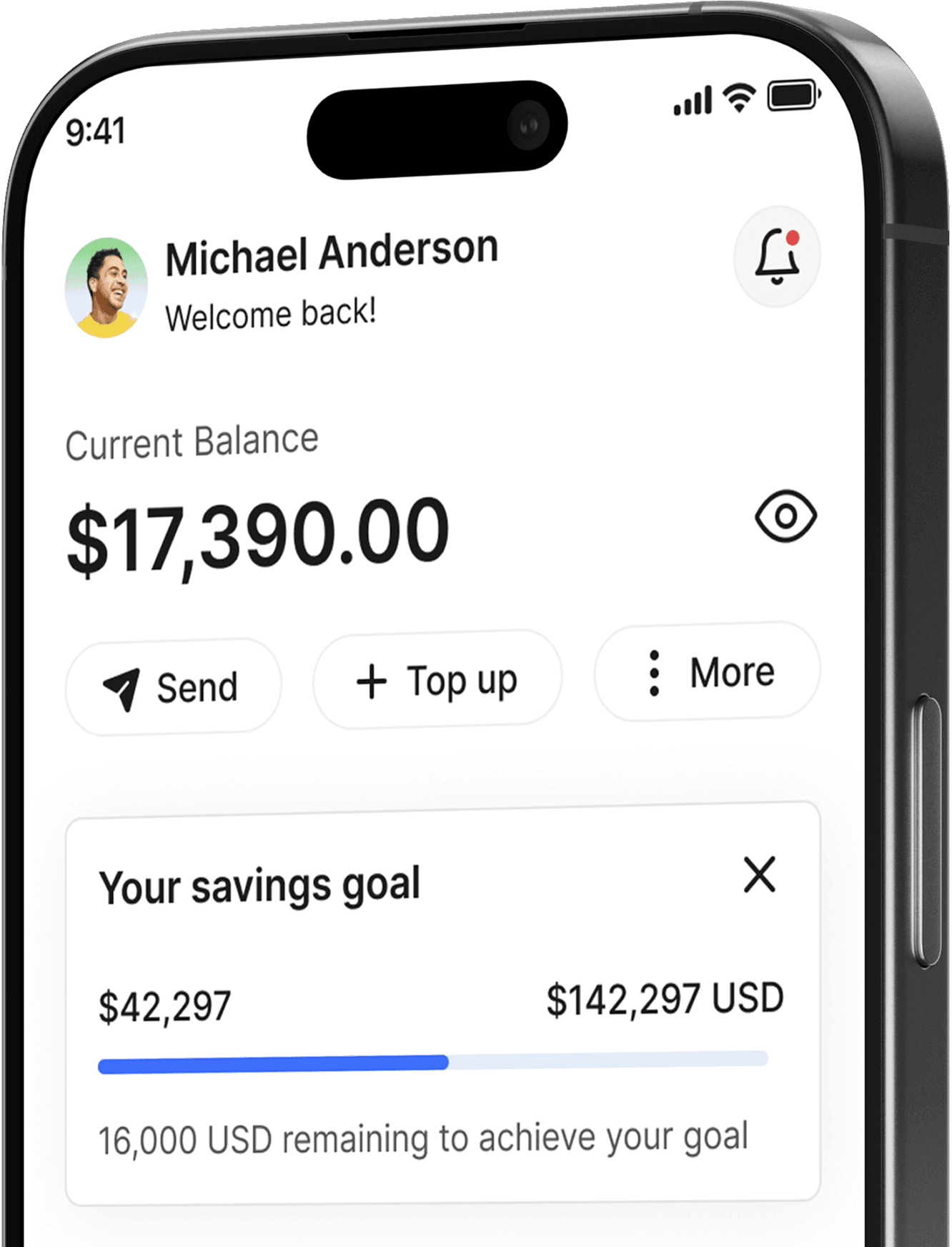

Neobanks, also known as digital-only or challenger banks, provide banking services entirely online. They offer mobile apps or web platforms for everything—from opening an account to making transfers, budgeting, and even investing. Examples include Chime, Revolut, N26, and in Bangladesh, bKash's upgraded financial services. Their appeal lies in convenience, innovation, and user-friendly interfaces.

What Are Traditional Banks?

Traditional banks have been around for decades and provide services through physical branches as well as digital platforms. They are regulated, established, and typically offer a wide range of financial services—such as savings accounts, loans, credit cards, and investment advice. Popular traditional banks in Bangladesh include Sonali Bank, Dutch-Bangla Bank, Islami Bank, and BRAC Bank.

Key Features: Digital Wallets vs. Bank Transfers

Digital wallets offer instant transactions, especially for peer-to-peer payments, bill payments, and online shopping. In contrast, bank transfers—especially interbank or international—can take hours to days, though they’re reliable for larger or formal transactions.

Digital wallets like bKash, PayPal, and Nagad are mobile-friendly and widely used for everyday transactions. Bank transfers, on the other hand, are better suited for transferring larger amounts, setting up recurring payments, or dealing with businesses and institutions.

Bank transfers are generally more secure for large sums due to strict banking regulations and account verification. Digital wallets offer strong encryption and two-factor authentication but may have higher risks if your phone is lost or hacked without proper safeguards.

Savings and Investment Made Easier

The digital age has also democratized savings and investment. Automatic savings plans, round-up features, and micro-investment apps such as Acorns and Robinhood have encouraged even low-income earners to start investing early. These tools often use gamification and AI-driven suggestions to nudge users toward better financial habits, contributing to long-term financial stability.

Digital Banking and Neobanks

Traditional banking has been transformed by the emergence of neobanks—fully digital banks that operate without physical branches. These banks often offer lower fees, higher interest rates, and faster services. Their user-friendly interfaces cater to tech-savvy individuals who prefer digital convenience over traditional banking models.

Accessibility and Inclusivity

One of the greatest advantages of digital finance is its potential to increase financial inclusion. Individuals in remote or underserved areas can now access banking services, apply for loans, and invest—all through a smartphone. This has particularly helped women, youth, and low-income groups gain financial independence.

Conclusion

Neobanks are revolutionizing how people think about banking—offering speed, simplicity, and lower fees. But traditional banks still offer unbeatable support, trust, and service variety. Ultimately, your choice should reflect your lifestyle, digital habits, and financial needs. For many people, a hybrid approach works best—using neobanks for daily transactions and budgeting, while keeping a traditional bank account for savings, credit, or loans.