Understanding Financial Wellness in the Digital Age

Understanding Financial Wellness in the Digital Age

Nov 21, 2025

7 min read

Financial wellness refers to the overall health of an individual's financial life. It includes the ability to manage day-to-day finances, cope with unexpected expenses, plan for future goals, and feel secure in one's financial future. In the digital age, the concept of financial wellness has expanded, incorporating new tools and technologies that make money management more accessible and efficient for individuals around the world.

The Role of Technology in Modern Finance

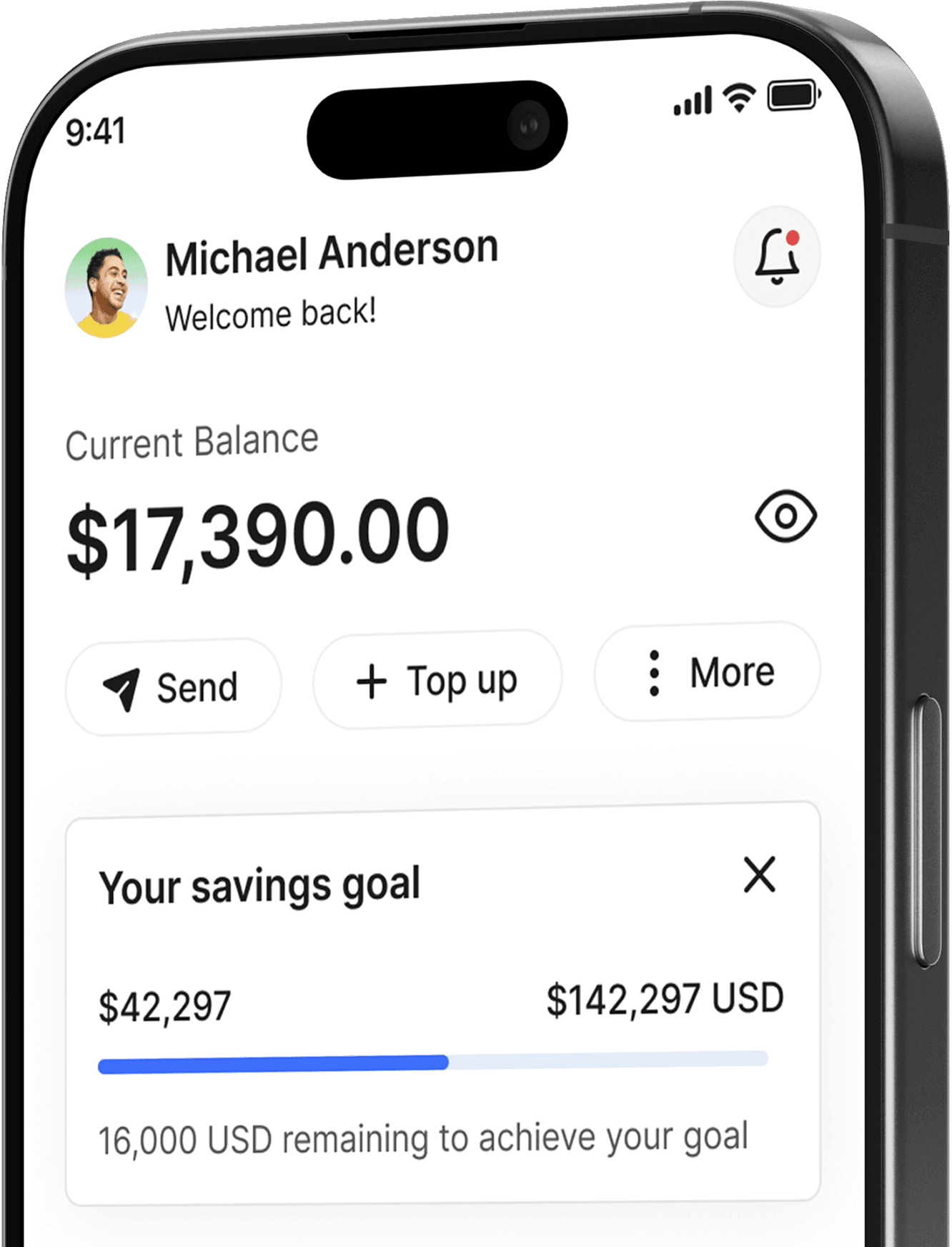

The digital revolution has dramatically reshaped how we interact with our finances. Mobile banking, online payments, budgeting apps, and robo-advisors have simplified financial tasks that once required significant time and effort. These innovations have not only enhanced convenience but also empowered individuals with tools to track, plan, and grow their finances in real time.

Budgeting and Expense Tracking in the Digital Era

One of the pillars of financial wellness is effective budgeting, and digital platforms have made this process easier than ever. Apps like Mint, YNAB (You Need A Budget), and PocketGuard allow users to set budgets, categorize spending, and receive alerts when they’re overspending. These tools help individuals gain greater control over their finances, leading to more informed decisions.

Key Features of Financial Wellness in the Digital Age

Digital tools make it easy to access financial information anytime, anywhere. Mobile apps and online platforms let users check balances, track spending, and manage accounts on the go, increasing control and awareness over finances.

Automation helps with tasks like bill payments and savings, ensuring consistency. Personalization tailors financial advice and alerts based on user behavior, helping individuals stay aligned with their goals.

Modern finance apps analyze user data to provide reports, trends, and smart suggestions. These insights help users understand their habits and make better decisions for long-term financial health.

Savings and Investment Made Easier

The digital age has also democratized savings and investment. Automatic savings plans, round-up features, and micro-investment apps such as Acorns and Robinhood have encouraged even low-income earners to start investing early. These tools often use gamification and AI-driven suggestions to nudge users toward better financial habits, contributing to long-term financial stability.

Digital Banking and Neobanks

Traditional banking has been transformed by the emergence of neobanks—fully digital banks that operate without physical branches. These banks often offer lower fees, higher interest rates, and faster services. Their user-friendly interfaces cater to tech-savvy individuals who prefer digital convenience over traditional banking models.

Financial Literacy and Digital Tools

Despite the availability of digital financial tools, many people struggle with financial literacy. Fortunately, the internet is full of accessible resources such as blogs, webinars, and e-learning platforms that provide financial education. Fintech companies are also integrating educational content into their apps, helping users understand financial concepts while they manage their money.

Conclusion

In the digital age, financial wellness is more achievable than ever but it requires a proactive approach. By blending traditional financial principles with modern technology, individuals can build a stronger, more resilient financial future.