Build wealth through smarter financial planning

Build wealth through smarter financial planning

Nov 29, 2025

9 min read

Saving money used to be a manual task one that required discipline, planning, and effort. But today, automation is transforming the way we save, making it easier, faster, and smarter. Whether it’s setting aside a few taka each day or building an emergency fund without lifting a finger, automated saving tools are reshaping personal finance for the better.

The Rise of Automated Transfers

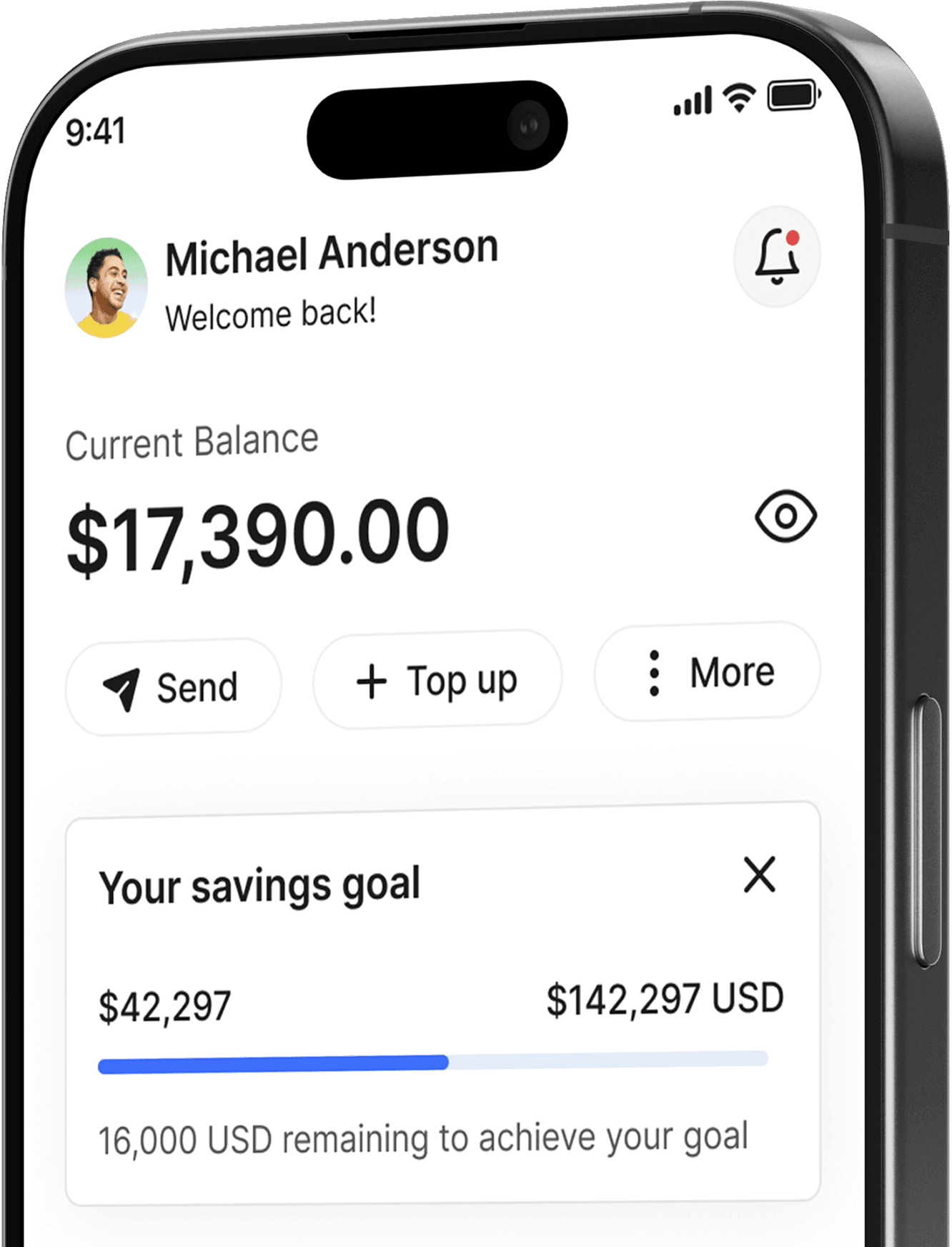

One of the most common automation tools is scheduled transfers. Banks and fintech apps allow users to set up recurring transfers from checking to savings accounts. This “pay yourself first” model ensures savings happen regularly, helping people build emergency funds or save toward specific goals without actively thinking about it.

Round-Up Savings and Micro-Investing

Many apps now offer round-up features that round your purchases to the nearest dollar and save the difference automatically. For example, if you spend $3.45, the app will round it up to $4 and save 55 cents. This small change accumulates surprisingly fast, helping people save money without feeling the pinch.

Key Features of Automated Saving

Automation ensures regular contributions without manual input, building financial discipline over time.

Many tools adjust savings amounts based on income, expenses, or personal goals, creating a customized saving plan.

Automated savings systems often integrate with budgeting tools, investment apps, or employer payrolls—offering a full financial picture.

Financial Education and Automated Savings

Many automated savings platforms include educational content, helping users understand the importance of saving and investing. By combining automation with learning, these platforms empower users to improve their financial literacy and make better money decisions.

Automation Reduces Emotional Spending

Humans tend to make impulsive decisions when emotionally triggered. Automation removes emotion from the equation by setting and following saving rules. This disciplined approach helps avoid the temptation to spend money meant for savings.

The Future of Automated Savings

As technology advances, automated saving tools will become more intelligent and integrated. Future innovations may include predictive saving based on life events, real-time financial advice, and deeper integration with AI-powered financial planning tools. Automation will continue to be a powerful ally in building wealth effortlessly.

Conclusion

Automation is not just a convenience it’s a powerful financial strategy. By removing the barriers to saving, it helps people of all income levels build better financial futures with less effort. In today’s digital age, the smartest way to save may be the one that runs quietly in the background automatically, consistently, and effectively.